7 Genius Hacks to Crush Student Loans and Retirement Savings

Balancing student loans and retirement savings can feel like juggling flaming torches while riding a unicycle. For many, the burden of student debt clashes with the urgent need to save for the future, creating a financial tug-of-war. But with the right strategies, you can tackle both goals without sacrificing one for the other. In this article, we’ll share practical, actionable tips to help you manage these dual financial priorities effectively, ensuring you pay off your loans while building a secure retirement nest egg.

Why Balancing Student Loans and Retirement Savings Matters

Student loan debt in the U.S. has skyrocketed, with over 45 million borrowers owing a collective $1.7 trillion. Meanwhile, studies show that 60% of Americans are behind on retirement savings, with many having less than $50,000 saved by their 50s. Neglecting either goal can have long-term consequences: defaulting on loans can tank your credit, while underfunding retirement could leave you working well into your golden years. The good news? With smart planning, you can address both without feeling overwhelmed.

Here are seven practical tips to help you master student loans and retirement savings like a pro.

1. Prioritize High-Interest Debt First

Not all debt is created equal. If your student loans carry high interest rates (say, 6% or more), prioritize paying them off before funneling extra cash into retirement accounts. High-interest debt grows faster than most retirement investments, eating into your wealth over time.

Action Step: List all your student loans by interest rate. Focus extra payments on the highest-rate loan while making minimum payments on others. Use the avalanche method to save thousands in interest over time.

2. Maximize Employer Retirement Matches

If your employer offers a 401(k) match, treat it like free money—because it is. Many companies match contributions up to a certain percentage of your salary (e.g., 50% of the first 6%). Failing to contribute enough to get the full match is like leaving cash on the table.

Action Step: Contribute at least enough to your 401(k) to capture the full employer match. For example, if your employer matches 50% of contributions up to 6% of your $50,000 salary, contribute $3,000 annually to get an extra $1,500 from your employer.

3. Explore Income-Driven Repayment Plans

Federal student loans offer income-driven repayment (IDR) plans that cap payments at a percentage of your income (typically 10-20%). These plans can free up cash flow, allowing you to divert more money toward retirement savings.

Action Step: Check if you qualify for an IDR plan at studentaid.gov. Be aware of potential tax implications if your loan is forgiven after 20-25 years, and factor this into your long-term financial plan.

4. Automate Savings and Payments

Automation is your best friend when juggling student loans and retirement savings. Setting up automatic payments for your loans ensures you never miss a due date, which can protect your credit score. Similarly, automating retirement contributions helps you save consistently without the temptation to spend the money elsewhere.

Action Step: Set up autopay for your student loans (many lenders offer a 0.25% interest rate reduction for this). Schedule automatic transfers to your retirement account, even if it’s just $50 a month to start.

5. Start Small with Retirement Savings

If your budget is tight, don’t let the pressure to save “enough” for retirement stop you from starting. Even small contributions to a Roth IRA or 401(k) can grow significantly over time thanks to compound interest.

Action Step: Open a Roth IRA if you qualify (income limits apply) and contribute as little as $25-$50 per month. For example, $50 monthly at a 7% annual return could grow to over $40,000 in 30 years.

6. Refinance Private Loans for Lower Rates

If you have private student loans with high interest rates, refinancing could lower your monthly payments or total interest paid, freeing up cash for retirement savings. However, be cautious—refinancing federal loans into private ones means losing benefits like IDR or loan forgiveness.

Action Step: Shop around for refinancing options with lenders like SoFi or Earnest. Compare rates and terms, and only refinance if the savings outweigh the loss of federal protections.

7. Build an Emergency Fund Buffer

Unexpected expenses can derail your plans to pay off student loans or save for retirement. An emergency fund acts as a safety net, preventing you from dipping into retirement accounts or defaulting on loans during tough times.

Action Step: Aim for a starter emergency fund of $1,000, then gradually build to 3-6 months of expenses. Keep this in a high-yield savings account for easy access and modest growth.

Leverage Side Hustles for Extra Cash

If your budget feels stretched, a side hustle can provide extra income to split between student loans and retirement savings. Freelancing, tutoring, or gig work can generate hundreds of dollars a month.

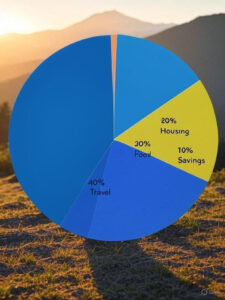

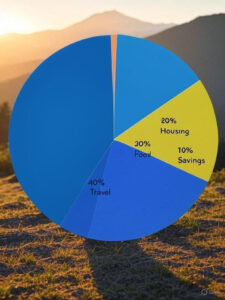

Action Step: Dedicate 50% of side hustle income to student loan payments and 50% to retirement savings. For example, a $500 monthly side hustle could mean $250 toward loans and $250 toward your 401(k) or IRA.

The Bottom Line

Balancing student loans and retirement savings doesn’t have to be an either-or situation. By prioritizing high-interest debt, maximizing employer matches, exploring repayment options, and automating your finances, you can make steady progress on both fronts. Start small, stay consistent, and adjust your strategy as your income grows. With these practical tips, you’ll be on your way to financial freedom and a secure retirement.

Ready to take control of your finances? Share your favorite tip in the comments or start implementing these strategies today!

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025