Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Imagine working from a beachside café in Bali one month and a cozy coworking space in Lisbon the next, all while building a secure financial future. For digital nomads, the freedom to live and work anywhere is exhilarating, but it comes with unique challenges—especially when planning for retirement. Retirement planning for digital nomads requires a tailored approach that balances location-independent income, tax complexities, and long-term savings goals. With 16.9 million Americans embracing the digital nomad lifestyle in 2023, a 131% jump from 2019, the need for strategic retirement planning is more critical than ever. This guide dives into actionable strategies to secure your financial future while embracing the nomadic life, offering insights for remote workers, freelancers, and entrepreneurs chasing freedom without sacrificing stability.

Why Retirement Planning Matters for Digital Nomads

Digital nomads thrive on flexibility, but this lifestyle can complicate traditional retirement planning. Unlike conventional employees with employer-sponsored 401(k) plans or pensions, nomads often rely on irregular income streams, face international tax obligations, and lack access to standard benefits. Planning for retirement ensures you can sustain your lifestyle long after your working years, whether you’re sipping coffee in Chiang Mai or exploring the fjords of Norway.

The Unique Challenges of Nomadic Retirement

Irregular Income: Freelancers and remote entrepreneurs often experience fluctuating earnings, making consistent savings difficult.

Tax Complexity: Navigating tax laws across multiple countries can erode savings if not managed properly.

Lack of Employer Benefits: No company-sponsored retirement plans or matching contributions.

Lifestyle Costs: Frequent travel and accommodation expenses can compete with savings goals.

According to a 2024 study by MBO Partners, 76% of digital nomads are self-employed, meaning they bear full responsibility for their financial future. Despite these challenges, strategic planning can turn the nomadic lifestyle into an asset for building wealth.

Building a Retirement Plan as a Digital Nomad

1. Establish Multiple Income Streams

A cornerstone of retirement planning for digital nomads is diversifying income to create stability. Relying solely on freelance gigs or a single client can be risky, especially during economic downturns or personal emergencies.

Actionable Tips for Income Diversification

Freelance Portfolios: Offer services like writing, graphic design, or SEO consulting on platforms like Upwork or Fiverr. For example, a travel blogger might also provide copywriting services for tourism brands.

Passive Income: Create digital products like eBooks, online courses, or affiliate websites. Michelle Schroeder-Gardner, a digital nomad and blogger at Making Sense of Cents, earns over $50,000 monthly through affiliate marketing and diversified income streams.

Invest in Dividend Stocks: Build a portfolio of dividend-paying stocks for steady passive income. A 2023 report by Vanguard shows that dividend stocks can yield 2-4% annually, providing reliable cash flow.

Side Hustles: Teach online, tutor, or consult in your niche to supplement income during lean months.

2. Choose the Right Retirement Accounts

Without access to employer-sponsored plans, digital nomads must proactively set up retirement accounts suited to their lifestyle. The key is selecting accounts that offer flexibility, tax advantages, and portability across borders.

Best Retirement Accounts for Nomads

Solo 401(k): Ideal for self-employed nomads, this plan allows contributions of up to $69,000 in 2025 (including employer and employee contributions). It’s portable and offers tax-deferred growth.

SEP IRA: Simplified Employee Pension plans are great for freelancers with variable income, allowing contributions of up to 25% of net earnings (max $69,000 in 2025).

Roth IRA: Contribute up to $7,000 annually (2025 limit) with after-tax dollars for tax-free withdrawals in retirement. Perfect for nomads expecting lower tax rates later.

Brokerage Accounts: For flexibility, invest in low-cost index funds or ETFs through platforms like Vanguard or Fidelity. While not tax-advantaged, they allow penalty-free withdrawals before retirement age.

How to Get Started

Open an account with a reputable provider like Fidelity or Charles Schwab, which offer international access.

Automate contributions to ensure consistent savings, even during travel-heavy months.

Consult a financial advisor familiar with cross-border taxation to optimize your strategy. Resources like Expat Wealth provide tailored advice for nomads.

Stat: A 2024 Fidelity study found that consistent contributions to retirement accounts, even in small amounts, can grow significantly over 20-30 years due to compound interest.

3. Navigate International Tax and Residency Issues

Taxation is a major hurdle for digital nomads, as working across multiple countries can trigger complex obligations. Proper planning minimizes tax liabilities and maximizes retirement savings.

Key Tax Considerations

Foreign Earned Income Exclusion (FEIE): U.S. citizens can exclude up to $126,500 of foreign-earned income in 2025 if they meet residency or physical presence tests. This reduces taxable income, freeing up funds for retirement savings.

Double Taxation Agreements: Research treaties between your home country and work destinations to avoid paying taxes twice. For example, the U.S. has agreements with over 60 countries, including Portugal and Thailand.

Local Tax Residency: Some countries, like Portugal with its Non-Habitual Resident (NHR) program, offer tax exemptions for digital nomads on certain income types for up to 10 years.

Practical Steps

Use accounting software like QuickBooks or Xero to track income and expenses across countries.

Hire a tax professional specializing in expat finances to ensure compliance. Firms like Taxes for Expats can help.

Consider establishing tax residency in a low-tax jurisdiction like Georgia or Malaysia if your lifestyle allows.

Example: Emma, a U.S.-based nomad, spends 330 days annually abroad to qualify for the FEIE. By excluding $100,000 of her income, she saves $24,000 in taxes, which she invests in a Roth IRA and index funds.

4. Plan for Healthcare and Emergency Funds

Healthcare costs and unexpected expenses can derail retirement savings. Digital nomads need robust plans to protect their finances while living abroad.

Healthcare Strategies

International Health Insurance: Providers like Cigna Global or SafetyWing offer plans tailored for nomads, covering emergencies and routine care worldwide. SafetyWing’s nomad insurance starts at $45/month.

Local Healthcare Systems: Research destination countries with affordable, high-quality healthcare, like Thailand or Mexico, to reduce costs.

Health Savings Account (HSA): If eligible (U.S. residents with high-deductible health plans), contribute up to $4,150 (2025 limit) for tax-free medical expenses.

Building an Emergency Fund

Save 6-12 months of living expenses in a high-yield savings account (e.g., Ally Bank offers 4% APY in 2025).

Keep funds accessible in a multi-currency account like Wise to avoid exchange rate losses.

Budget for unexpected costs like flight cancellations or device replacements, which are common for nomads.

Stat: A 2023 Nomad List survey found that 68% of digital nomads faced unexpected expenses abroad, emphasizing the need for a financial safety net.

Nomad-Friendly Emergency Fund Checklist

A well-planned emergency fund is essential for digital nomads to maintain financial security while navigating the uncertainties of a location-independent lifestyle. This checklist provides actionable steps to build and maintain an emergency fund tailored for life on the go.

Step 1: Determine Your Emergency Fund Goal

-

Calculate 6-12 months of living expenses: Account for rent, food, transportation, insurance, and travel costs. For example, if monthly expenses are $2,000, aim for $12,000-$24,000.

-

Factor in nomad-specific costs: Include visa fees, international flights, or device replacements (e.g., laptop or phone).

-

Adjust for income variability: Freelancers or self-employed nomads should lean toward 9-12 months due to irregular earnings.

Step 2: Choose the Right Account

Select a high-yield savings account: Opt for online banks like Ally Bank (4% APY in 2025) or Marcus for better returns.

Ensure international access: Confirm the account allows withdrawals or transfers abroad without high fees.

Consider multi-currency accounts: Use platforms like Wise or Revolut to hold funds in USD, EUR, or other currencies to avoid exchange rate losses.

Step 3: Automate Savings

Set up automatic transfers: Schedule monthly contributions (e.g., $200) from your checking account to your emergency fund.

Allocate windfalls: Deposit bonuses, tax refunds, or large client payments to boost the fund.

Start small if needed: Even $50/month adds up over time; increase contributions as income grows.

Step 4: Minimize Access for Non-Emergencies

Keep funds separate: Use a dedicated account to avoid dipping into the emergency fund for non-essential expenses.

Limit debit card access: Opt for an account without a linked card to reduce temptation.

Define emergencies: Create a list of valid uses (e.g., medical emergencies, job loss, unexpected travel).

Step 5: Plan for Accessibility Abroad

Verify ATM access: Ensure your bank partners with global ATM networks (e.g., Visa or Mastercard) for low-fee withdrawals.

Maintain a cash buffer: Carry $200-$500 in local currency for immediate needs in areas with limited banking access.

Set up digital backups: Store account details securely in a password manager like LastPass for quick access.

Step 6: Protect Against Currency Risks

Diversify currency holdings: Hold 50% of funds in a stable currency like USD or EUR to hedge against local currency fluctuations.

Monitor exchange rates: Use apps like XE Currency to time conversions for minimal loss.

Avoid high-fee exchanges: Use low-cost platforms like Wise for international transfers.

Step 7: Regularly Review and Replenish

Check quarterly: Adjust the fund based on lifestyle changes, such as moving to a higher-cost destination.

Replenish after use: If you withdraw funds, prioritize rebuilding the balance over non-essential spending.

Account for inflation: Increase your savings goal annually (e.g., 3% for 2025) to maintain purchasing power.

Additional Tips

Link to insurance: Pair your emergency fund with international health or travel insurance (e.g., SafetyWing) to reduce out-of-pocket costs.

Build a secondary fund: Once your primary fund is complete, save for non-urgent goals like new equipment or extended travel.

Join nomad communities: Engage with platforms like Nomad List to learn cost-saving tips from other nomads.

Note: This checklist is designed for digital nomads with variable incomes and global mobility. Tailor the savings goal and account choices to your specific destinations and financial situation.

Tools and Resources to Streamline Your Plan

Leveraging technology simplifies retirement planning for digital nomads. Here are top tools to stay organized and informed:

Investment Apps: Apps like Wealthfront or Betterment automate low-cost investing with diversified portfolios.

Budgeting Tools: YNAB (You Need A Budget) helps track expenses and allocate savings, even with variable income.

Tax Software: TurboTax or TaxAct offer expat-friendly versions for filing U.S. taxes from abroad.

Nomad Communities: Join platforms like Nomad List or Reddit’s r/digitalnomad for tips on tax-friendly destinations and retirement strategies.

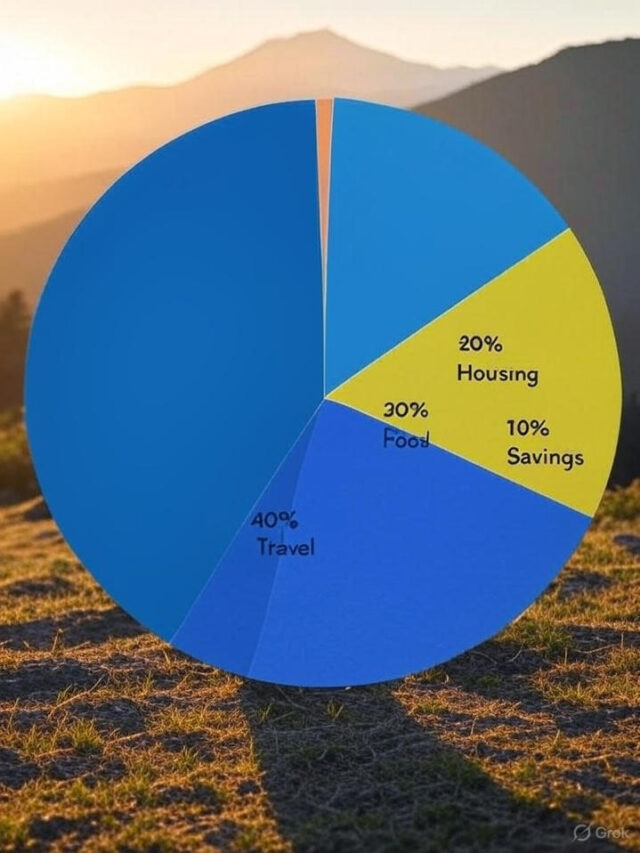

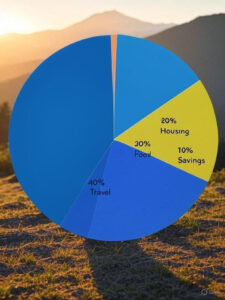

Balancing Lifestyle and Long-Term Goals

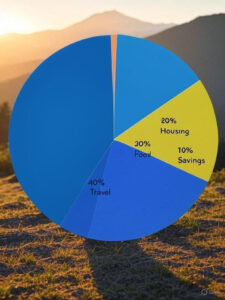

The nomadic lifestyle tempts many to prioritize experiences over savings, but balance is key. Set clear financial goals, like saving 15% of your income for retirement, while budgeting for travel adventures. For example, allocate $500 monthly for experiences (e.g., cultural tours, local dining) and $1,000 for investments to enjoy both the present and future.

Retirement planning for digital nomads is not just about saving money—it’s about crafting a financial strategy that supports your global adventures while securing your future. By diversifying income streams, choosing flexible retirement accounts, navigating international taxes, and preparing for healthcare and emergencies, you can build wealth without sacrificing freedom. Start small: open a Solo 401(k), automate savings, and consult a tax expert to optimize your plan. The nomadic life offers unparalleled flexibility, but it demands proactive planning to ensure long-term stability. Share your retirement planning tips or challenges in the comments below, or connect with our nomad finance community to learn more. Let’s build a future as vibrant as your travels!

Search More Skills

Pages

Categories

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

You Won’t Believe How Easy Healthy Food Access Can Be: Solutions to End Food Deserts!

Shocking Weight Gain Risks You NEED to Know Before It’s Too Late!

Why You’re Hitting an Energy Crash (And How to Stop It for Good!)

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025