Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

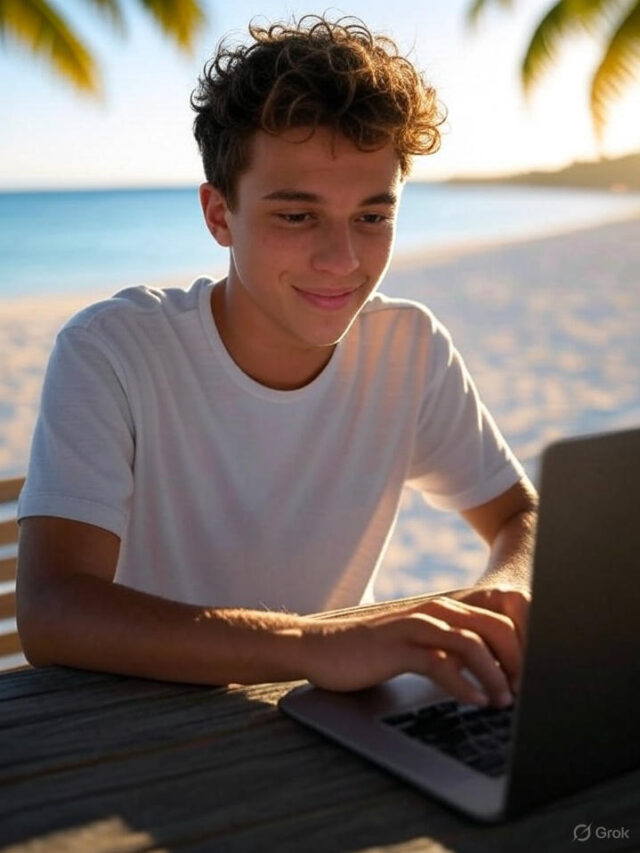

Imagine you’re a digital nomad, typing away on your laptop from a beach in Bali one month and a cozy café in Paris the next. The freedom is exhilarating—until tax season hits. Suddenly, you’re faced with a maze of rules, residency questions, and income sources from across the globe. Don’t worry, though—tax strategies for digital nomads can turn this headache into a manageable part of your lifestyle. In this guide, we’ll break down how to stay compliant, save money, and keep your nomadic dreams alive, all while navigating the complex world of taxes as a location-independent worker.

1. Understanding Tax Residency for Digital Nomads

What is Tax Residency?

Tax residency is the key factor determining where you owe taxes. For most people, it’s simple: live and work in one country, pay taxes there. But for digital nomads hopping between countries, it’s a different story. Each country has its own rules, often tied to how long you stay or your ties to the location.

How Does Tax Residency Affect You?

Many countries use the 183-day rule—spend more than 183 days there in a year, and you’re a tax resident. But it’s not always that clear-cut:

United States: Taxes citizens on worldwide income, no matter where they live.

Spain: Considers you a resident if your spouse or kids live there, even if you’re under 183 days.

Thailand: Taxes income earned within its borders if you stay 180+ days.

Crossing these thresholds without planning can lead to double taxation—paying taxes in two countries on the same income.

Tips for Managing Tax Residency

Track your days: Use an app like Days in Country to log your stays.

Choose a tax-friendly base: Countries like Portugal (Non-Habitual Resident program) or Malaysia (no tax on foreign income) can simplify your obligations.

Plan your travel: Spread your time across countries to stay below residency thresholds.

Example: A nomad spending 120 days in Bali, 100 in Portugal, and 80 in Thailand avoids residency anywhere, potentially reducing their tax burden.

2. Managing Multiple Income Sources

Types of Income Digital Nomads Earn

As a digital nomad, your income might come from:

Freelancing: Writing, designing, or coding for clients worldwide.

Remote jobs: A salary from a company in your home country or elsewhere.

Passive income: E-books, affiliate marketing, or rental properties.

Each stream has its own tax rules, depending on where it’s earned and where you’re taxed.

Tax Implications of Different Income Types

Freelance income: Often subject to self-employment taxes. In the U.S., this means a 15.3% Social Security and Medicare tax on top of income tax.

Remote employment: Your employer’s location matters. A U.K. company paying you in Portugal might trigger U.K. tax obligations unless a treaty applies.

Passive income: Taxed based on source or residency. For instance, U.S. nomads report rental income globally, but might offset it with the Foreign Tax Credit.

Stat: According to a 2023 Nomad List survey, 68% of digital nomads have at least two income sources, complicating their tax filings.

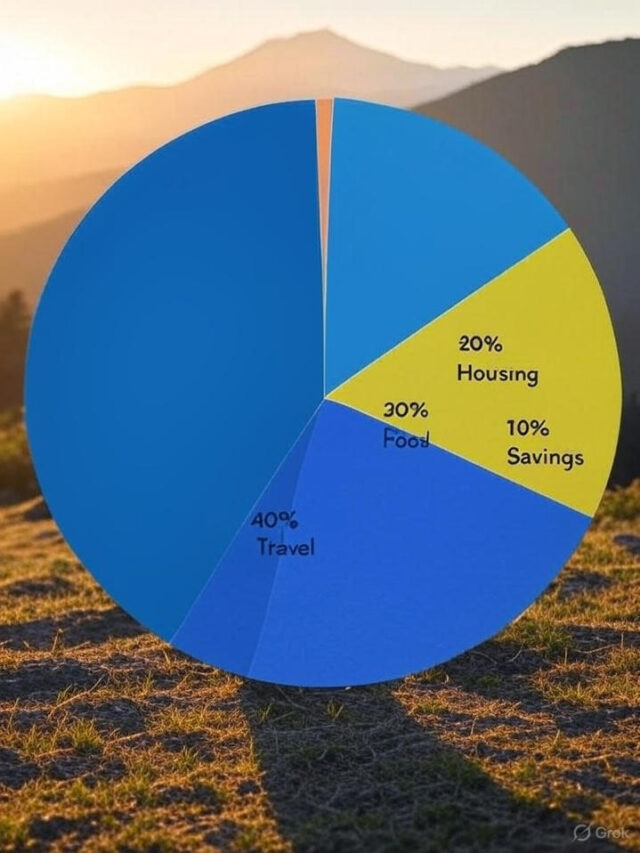

Strategies for Reporting and Paying Taxes

Organize with software: Tools like QuickBooks track income across sources and currencies.

Save proactively: Set aside 25-30% of each payment for taxes in a separate account.

File smartly: If you’re a U.S. citizen, use the Foreign Earned Income Exclusion (FEIE) to exclude up to $112,000 (2025 limit) of foreign-earned income.

3. Leveraging Tax Treaties and Deductions

What Are Tax Treaties?

Tax treaties are agreements between countries to avoid double taxation. They clarify which country taxes what income, saving you from paying twice. Over 90 countries have treaties with the U.S., for example, including Germany and Japan.

How Can Digital Nomads Use Them?

Avoid double taxation: A Canadian nomad working for a U.S. client might pay taxes only in Canada under the U.S.-Canada treaty.

Claim credits: If you pay tax in Spain but are a U.K. resident, the U.K. might credit you for Spanish taxes paid.

You’ll need forms like the W-8BEN (for non-U.S. residents) or 8833 (for treaty claims) to activate these benefits.

Common Deductions for Digital Nomads

Work-related travel: Flights or coworking space fees tied to your job.

Home office: A portion of rent or internet costs if you work from your accommodation.

Equipment: Laptops, software subscriptions, or online courses.

Example: A nomad spending $1,200/year on coworking spaces and $2,000 on flights could deduct $3,200, lowering their taxable income significantly.

4. Tools and Resources for Tax Management

Software and Apps for Tax Planning

Staying on top of taxes requires the right tools:

TaxBird: Tracks residency and estimates tax obligations for nomads.

Xero: Manages multi-currency income and expenses seamlessly.

Wise: A multi-currency account to handle payments and conversions with low fees.

Professional Services for Digital Nomads

For complex cases, professionals can help:

Expat tax experts: Firms like Greenback Expat Tax Services specialize in nomad taxes.

Local accountants: Hire someone familiar with the tax laws of your base country.

Online Communities and Forums

r/digitalnomad: A Reddit community sharing real-world tax tips.

Nomad List: Offers resources and forums for tax advice from fellow nomads.

Taxes don’t have to derail your digital nomad journey. By mastering tax strategies for digital nomads—understanding residency, managing income streams, leveraging treaties, and using smart tools—you can stay compliant and keep more of your earnings. The key is preparation: track your days, save consistently, and seek expert advice when the rules get murky.

Ready to take control? Start implementing these strategies today and share your own tax tips in the comments below. Want more nomad advice? Subscribe to our newsletter for fresh insights every month!

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

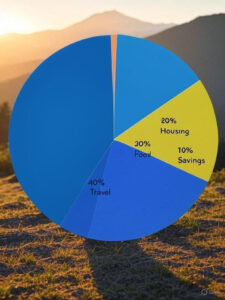

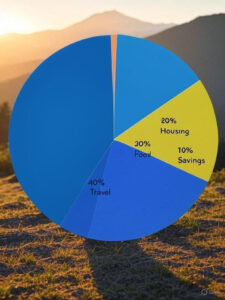

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

Pages

Categories

Web Stories

Recent Posts

Search More Skills

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025