Mastering Budgeting for Digital Nomads: Your Ultimate Guide

Imagine sipping coffee in a bustling Bangkok market one day and working from a serene mountain cabin in Portugal the next. The digital nomad lifestyle promises freedom, flexibility, and adventure—but it also comes with financial challenges that can catch even the savviest travelers off guard. Budgeting for digital nomads isn’t just about pinching pennies; it’s about crafting a sustainable plan that fuels your wanderlust without draining your bank account. With 15 years of blogging and living this lifestyle across continents, I’ve learned a thing or two about keeping finances in check. In this 1500+ word guide, I’ll share actionable budgeting tips tailored to digital nomads—because your dream of working from anywhere shouldn’t come with a side of financial stress.

Understanding the Digital Nomad Lifestyle

The allure of being a digital nomad lies in its independence. You’re not chained to a 9-to-5 or a single zip code—your office is wherever you plug in your laptop. But this freedom has a flip side: financial unpredictability. A 2023 Nomad List survey found that 68% of digital nomads struggle with budgeting due to fluctuating incomes and ever-changing costs of living. Whether you’re a freelance designer, a remote developer, or an online entrepreneur, your earnings might soar one month and dip the next. Add in visa fees, exchange rates, and spontaneous travel, and you’ve got a recipe for financial chaos—unless you plan ahead. Let’s break down how to master budgeting for digital nomads with practical, real-world strategies.

Creating a Budget That Works Anywhere

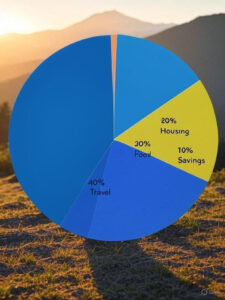

A solid budget is your roadmap to financial freedom as a nomad. Here’s how to build one that adapts to your globe-trotting life:

Track Every Penny

You can’t control what you don’t measure. Start by tracking your expenses daily—every coffee, coworking pass, and SIM card. Apps like Trail Wallet (designed for travelers) or YNAB (You Need a Budget) make this easy, supporting multiple currencies and syncing across devices. I once discovered I was spending $50 a month on overpriced airport snacks—tracking helped me cut that habit fast.

Leverage Budgeting Tools

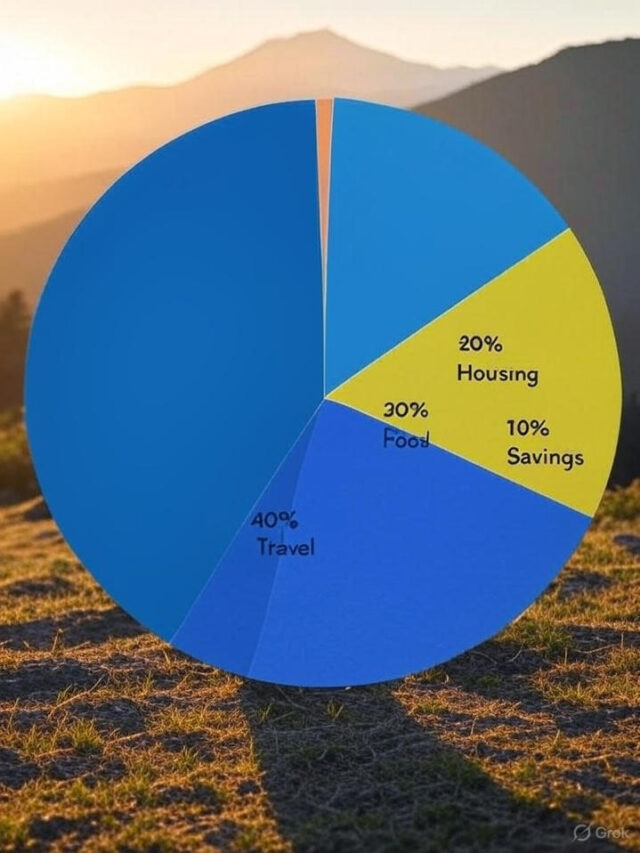

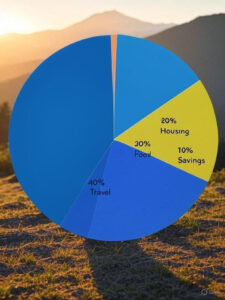

Tech is your ally. Apps like Revolut and Wise offer multi-currency accounts with low fees—perfect for paying in THB one day and EUR the next. Set spending limits and get alerts to avoid overspending. Pro tip: Use their budgeting features to categorize expenses (e.g., “Travel,” “Food,” “Work”) for a clearer picture.

Saving on Accommodation Without Sacrificing Comfort

Accommodation often eats up the biggest chunk of a nomad’s budget. Here’s how to keep it affordable without sleeping on park benches:

Hostels and Co-Living Spaces

Hostels aren’t just for backpackers—many, like those listed on Hostelworld, offer private rooms and reliable Wi-Fi for remote work. Co-living spaces like Selina blend affordability with community, offering desks and networking events. In Medellín, I paid $400/month for a co-living spot that would’ve cost triple in a traditional apartment.

Long-Term Airbnb Discounts

Booking Airbnb for a week? Ask for a discount. Staying a month? Negotiate harder—hosts often slash 10-30% for longer stays. I once scored a cozy Lisbon flat for $600/month (down from $900) just by messaging the host. Always check the “monthly stay” filter for pre-discounted options.

House-Sitting for Free Stays

Why pay when you can stay for free? Platforms like TrustedHousesitters connect nomads with homeowners needing pet or house care. In New Zealand, I lived rent-free in a stunning villa for two weeks, feeding a cat and watering plants. It’s a budget win and a cultural immersion.

Managing Travel Costs Like a Pro

Frequent travel is a nomad’s joy—and a budget’s nemesis. Here’s how to explore the world without going broke:

Fly Smart with Budget Airlines

Tools like Skyscanner and Google Flights unearth dirt-cheap fares. Be flexible—shifting your flight by a day or opting for a layover can halve the cost. I flew Bangkok to Hanoi for $40 once by traveling midweek. Check baggage fees, though—those add up.

Time Your Trips Right

Peak seasons mean peak prices. Research off-peak times (e.g., Europe in late fall, Southeast Asia post-monsoon) for cheaper flights and stays. A 2022 Kayak report showed off-peak travel saves 15-30% on average. Plus, fewer tourists mean better workspace vibes.

Rack Up Travel Rewards

Loyalty pays off. Join airline programs or use travel-friendly credit cards like the Chase Sapphire Preferred. I’ve redeemed points for free flights to Japan and hotel stays in Mexico—small sign-up efforts, big savings. Always read the fine print for blackout dates.

Eating on a Budget Without Starving

Food costs can spiral in tourist hubs, but you don’t need to survive on instant noodles. Here’s how to eat well for less:

Cook When You Can

Choose accommodations with kitchens—hostels, Airbnbs, or co-living spaces often have them. Cooking saves 50-70% compared to dining out. In Chiang Mai, I’d spend $10 at a market for a week’s worth of veggies and rice instead of $5 per meal at restaurants.

Shop Local Markets

Supermarkets are convenient but pricier. Hit local markets for fresh, cheap ingredients—think mangoes in Thailand or olives in Greece. It’s budget-friendly and a cultural deep dive. In Mexico, I’d grab tacos’ worth of supplies for $3 versus $10 at tourist joints.

Dodge the Tourist Traps

Restaurants near landmarks jack up prices. Walk a few blocks or ask locals where they eat. Apps like TripAdvisor or Yelp can guide you to hidden gems. In Bali, I found a warung (local eatery) serving $2 noodle bowls—tasty and wallet-friendly.

Mastering budgeting for digital nomads is about striking a balance: embracing the thrill of new horizons while keeping your finances grounded. Track your spending, save smart on stays and travel, and eat like a local to stretch your dollars further. With these tips—honed over 15 years of blogging and nomading—you can live this lifestyle sustainably, whether you’re in a hammock in Costa Rica or a coworking space in Berlin. What’s your go-to budgeting trick? Drop it in the comments—I’d love to hear how you make nomad life work for you. Share this guide with your fellow wanderers, and let’s keep the adventure alive!

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

Search More Skills

Categories

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom