Mastering Digital Nomad Finance: A Comprehensive Guide

Imagine waking up in a new country every few months, working from a beachside café, and still having your finances in order. Sounds like a dream, right? For countless digital nomads, this is reality—but it’s not without its hurdles. Financial planning takes on a new level of complexity when your office is wherever your laptop is, and your income might ebb and flow like the tides. That’s where digital nomad finance comes in—a tailored approach to managing money for location-independent workers. In this guide, we’ll dive into budgeting, saving, and investing strategies designed for those who thrive on freedom and flexibility. Whether you’re a seasoned globetrotter or just dipping your toes into remote work, these insights will empower you to take control of your financial future.

1. Budgeting for the Digital Nomad Lifestyle

Budgeting is the bedrock of financial stability, but for digital nomads, it’s a balancing act. Irregular income, shifting exchange rates, and the costs of a nomadic life demand a proactive approach. Let’s break it down.

1.1. Tracking Income and Expenses Across Currencies

Living in Bali one month and Berlin the next means your expenses—and sometimes your income—span multiple currencies. Keeping tabs on your finances can feel like solving a puzzle.

Actionable Tip: Use budgeting apps like Trail Wallet or YNAB (You Need A Budget) that handle multi-currency tracking. These tools convert your spending into a base currency, giving you a unified view of your money.

Example: If you earn in USD but spend in Thai Baht, a good app will adjust for exchange rates in real-time, helping you avoid overspending due to miscalculations.

Stat: A 2023 Nomad List survey found that 68% of digital nomads use at least one budgeting app to manage their finances—proof that tech is a game-changer here.

1.2. Planning for Irregular Income

Freelancers and remote contractors know the feast-or-famine cycle all too well. One month you’re flush with cash; the next, you’re scraping by. Budgeting for this unpredictability is key to mastering digital nomad finance.

Actionable Tip: Calculate your average monthly income over the past 12 months and build your budget around that. Stash extra earnings from good months into a buffer fund for leaner times.

Example: If your average is $3,000 but you earn $5,000 one month, save the extra $2,000. It’ll cushion you when a $1,500 month rolls around.

Insight: According to MBO Partners, 45% of digital nomads face income swings of 20% or more monthly. A solid buffer can turn stress into stability.

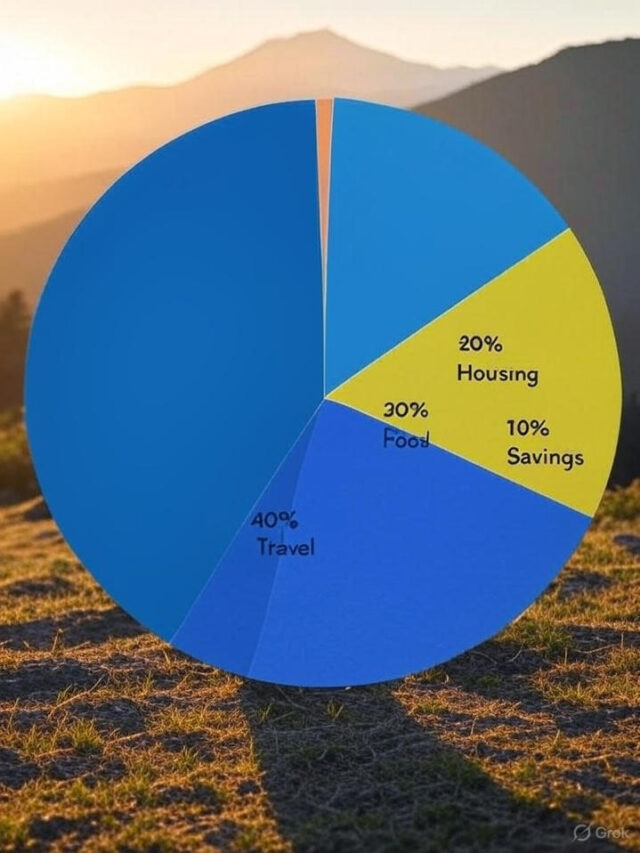

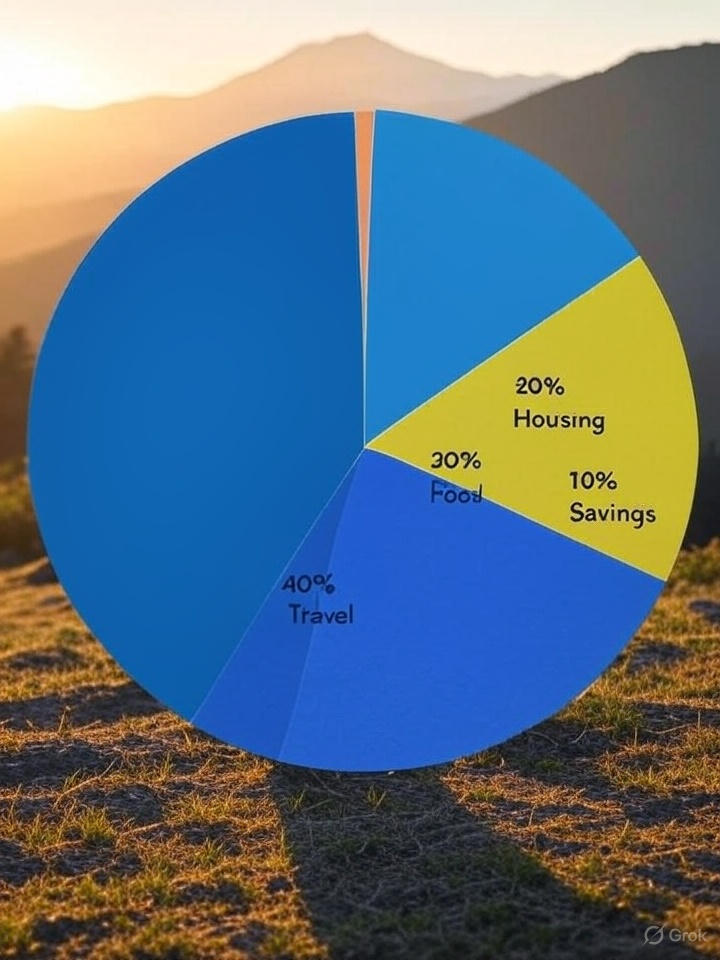

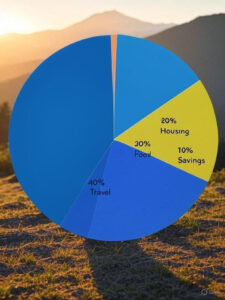

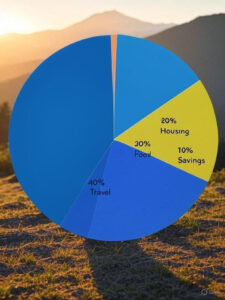

1.3. Managing Travel and Accommodation Costs

Flights, visas, and rentals can eat into your budget faster than you can say “next destination.” Smart planning keeps these costs in check.

Actionable Tip: Embrace slow travel—staying in one spot for a few months—to cut transportation expenses. Pair this with travel hacking (think credit card points) for cheaper flights.

Example: Renting an Airbnb in Lisbon for three months instead of one can slash your housing costs by up to 30%, per Airbnb’s 2024 trends report.

Pro Tip: Use sites like Nomad List to find affordable, nomad-friendly cities with low cost-of-living indices.

2. Saving Strategies for Location-Independent Workers

Saving isn’t just about stashing cash—it’s about building a safety net and funding your dreams, no matter where you are in the world. For digital nomads, this requires intentionality.

2.1. Building a Robust Emergency Fund

When you’re on the move, emergencies—like a lost laptop or sudden medical bill—can hit harder. An emergency fund is your first line of defense.

Actionable Tip: Aim for 3-6 months of living expenses in a high-yield savings account accessible globally, like Ally or Wise.

Stat: A 2024 MBO Partners study revealed that 60% of digital nomads have an emergency fund, yet only 40% feel secure about long-term planning. Don’t skimp here.

Example: If your monthly expenses are $2,000, target $6,000-$12,000. It’s a lifeline when a client payment delays or a visa snag forces a detour.

2.2. Automating Your Savings

Between time zones and travel itineraries, saving can slip through the cracks. Automation ensures it doesn’t.

Actionable Tip: Set up automatic transfers to your savings account every payday. Even $100 a month adds up—$1,200 a year, plus interest.

Example: With a 2% interest rate, saving $200 monthly grows to over $12,500 in five years. That’s a plane ticket home or a new laptop, funded passively.

Insight: Apps like Acorns round up your purchases and save the change—small habits, big wins.

2.3. Saving for Long-Term Goals

Nomads dream big—buying a home base, launching a startup, or retiring on a beach. Long-term savings make it happen.

Actionable Tip: Open separate accounts for each goal (e.g., “House Fund”) and contribute regularly. Micro-investing apps like Betterment can grow small sums over time.

Example: Investing $500 monthly at a 7% return could hit $400,000 in 20 years—retirement sorted, nomad-style.

Pro Tip: Check out our guide to remote work productivity for tips on earning more to save more.

3. Investing as a Digital Nomad

Investing builds wealth, but for nomads, it’s about flexibility and resilience. Currency swings and tax complexities shouldn’t stop you from growing your money.

3.1. Choosing Accessible Investment Accounts

You need accounts that follow you wherever you roam, with no geographic ties holding you back.

Actionable Tip: Opt for platforms like Charles Schwab or Interactive Brokers, offering global access and low fees.

Example: A Roth IRA or taxable brokerage account lets you invest in stocks or ETFs from a café in Chiang Mai or a coworking space in Medellín.

Stat: Vanguard reports that 70% of nomads prefer online brokers for their portability—join the club.

3.2. Diversifying to Mitigate Currency Risk

With income in USD and expenses in Euros, Pesos, or Yen, currency fluctuations can sting. Diversification softens the blow.

Actionable Tip: Spread investments across international stocks, bonds, and ETFs to balance risk.

Example: A global ETF like VT (Vanguard Total World Stock) covers 9,000+ companies worldwide, hedging against any single currency’s dip.

Insight: A diversified portfolio cuts volatility by up to 20%, per Vanguard’s 2023 analysis.

3.3. Navigating Tax Implications

Taxes get messy when you’re earning in one country and living in another. Stay compliant without overpaying.

Actionable Tip: Hire a tax pro versed in expat or nomad taxes—worth every penny. Research programs like Portugal’s Non-Habitual Resident (NHR) for tax breaks.

Example: The NHR can slash your tax rate to 10% on foreign income for a decade—more money for digital nomad finance goals.

Resource: Check IRS guidelines or expat tax blogs for clarity.

Mastering digital nomad finance isn’t just about surviving—it’s about thriving. Budgeting keeps you grounded, saving builds your safety net, and investing grows your wealth, all while you chase sunsets worldwide. The secret? Stay adaptable, use the right tools, and plan ahead. Start today—track your spending, automate a savings transfer, or open an investment account. Your future self will thank you. Got your own nomad finance hacks? Share them in the comments—I’d love to hear how you’re making it work!

Pages

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

You Won’t Believe How Easy Healthy Food Access Can Be: Solutions to End Food Deserts!

Shocking Weight Gain Risks You NEED to Know Before It’s Too Late!

Why You’re Hitting an Energy Crash (And How to Stop It for Good!)

Search More Skills

Categories

Recent Posts

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025