Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

Living as a digital nomad offers unparalleled freedom to work from anywhere, whether it’s a beach in Bali or a café in Lisbon. But this lifestyle comes with financial challenges that can derail your adventures if not managed wisely. Saving money as a digital nomad isn’t just about cutting costs—it’s about strategic planning, prioritizing value, and maintaining a sustainable lifestyle. With 15 years of experience as a global blogger, I’ve learned how to stretch a budget across continents without sacrificing experiences. In this 1500+ word guide, I’ll share actionable strategies to help you save money while thriving as a digital nomad. From budgeting hacks to choosing affordable destinations, these tips will empower you to live your dream life without breaking the bank.

Why Saving Money as a Digital Nomad Matters

The digital nomad lifestyle is booming. According to a 2023 report by MBO Partners, over 17 million Americans identify as digital nomads, a 131% increase since 2019. Yet, financial instability remains a top concern for many. Without a steady paycheck or employer benefits, nomads must rely on smart financial habits to sustain their travels. Saving money as a digital nomad allows you to:

Extend your travels without financial stress.

Build a safety net for unexpected expenses.

Invest in experiences that enrich your life, like cultural tours or skill-building courses.

Let’s dive into three core strategies to help you save money while living the nomadic dream.

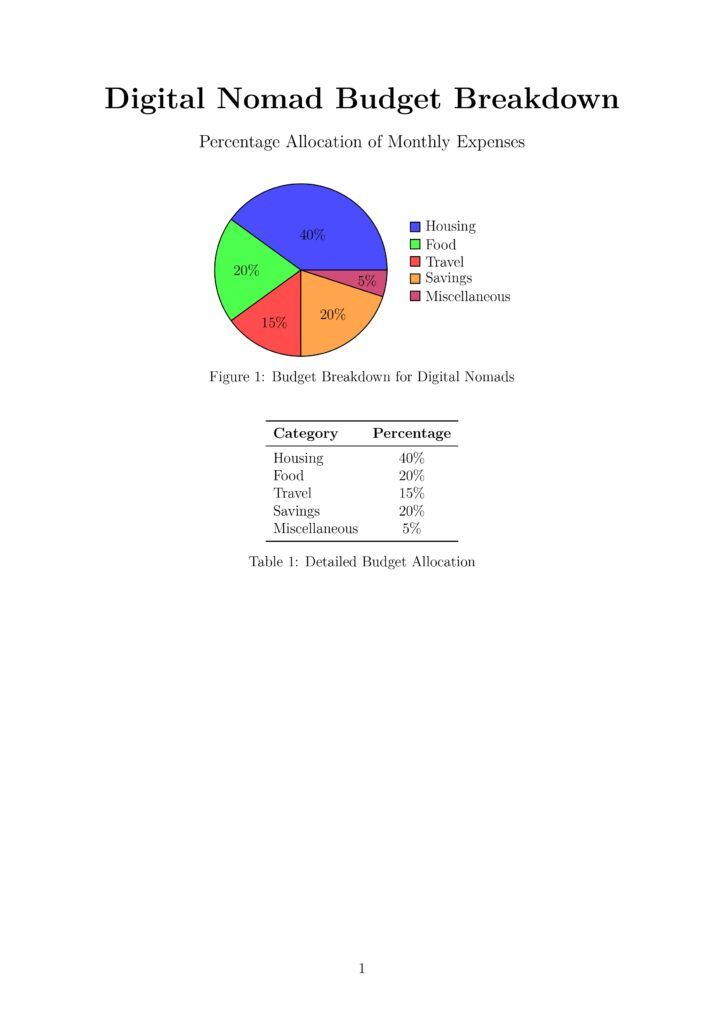

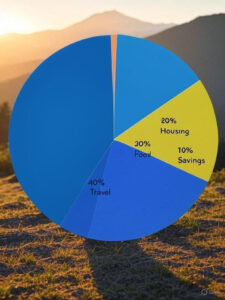

1. Master Budgeting for a Nomadic Lifestyle

Create a Flexible Budget

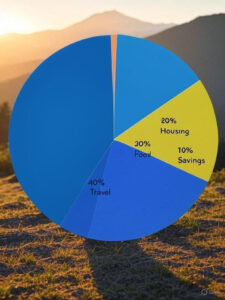

Budgeting is the cornerstone of saving money as a digital nomad. Unlike traditional lifestyles, your expenses fluctuate based on location, currency exchange rates, and travel frequency. A flexible budget accounts for these variables while keeping your finances in check.

Track Your Income and Expenses: Use apps like YNAB (You Need A Budget) or PocketGuard to monitor your cash flow. These tools sync with bank accounts and categorize expenses, making it easy to spot overspending.

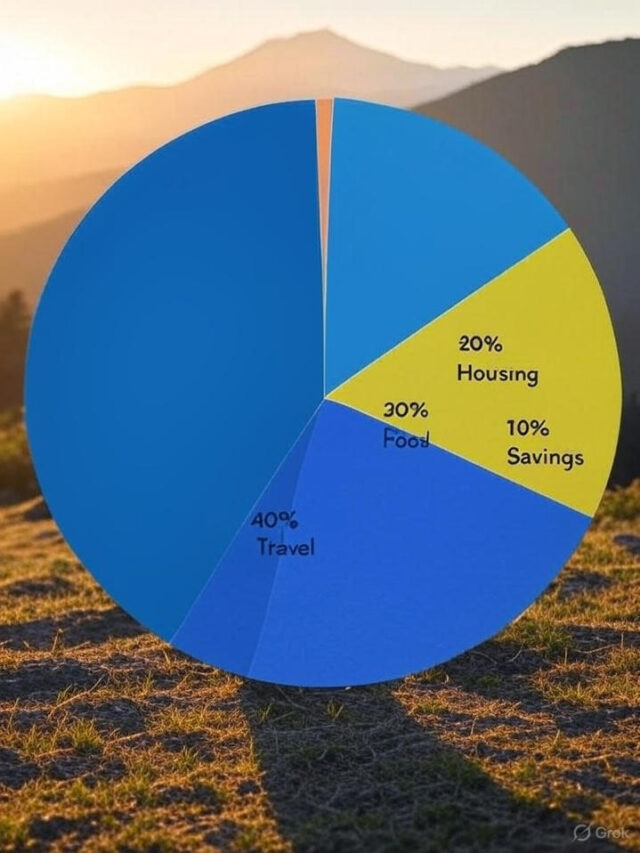

Set a Monthly Savings Goal: Aim to save 20-30% of your income for emergencies or future investments. For example, if you earn $3,000 monthly, allocate $600-$900 to savings.

Adjust for Cost of Living: Research your destination’s cost of living using sites like Numbeo (https://www.numbeo.com). A month in Chiang Mai, Thailand, might cost $1,000, while Lisbon could run $2,500.

Minimize Fixed Costs

Fixed costs like subscriptions or rent can drain your budget. Here’s how to cut them:

Cancel Unused Subscriptions: Audit your subscriptions (Netflix, Spotify, etc.) and eliminate those you rarely use. Consider sharing plans with friends or family to split costs.

Opt for Digital Tools: Use free or low-cost tools like Google Suite or Notion for productivity instead of premium software.

Ditch Traditional Rent: Instead of maintaining a home base, store belongings with family or use affordable storage units. For example, a 5×5 storage unit in the U.S. averages $40/month (source: SpareFoot).

Automate Your Savings

Automation ensures you save before you spend. Set up automatic transfers to a high-yield savings account, like Ally Bank (2.5% APY as of 2025). Even $50 a week adds up to $2,600 annually, enough for a round-trip flight to Europe or Asia.

Pro Tip: Create a “Nomad Fund” for travel-specific expenses like visas or gear. Apps like Wise (https://wise.com) offer low-fee international transfers, helping you save on currency conversions.

2. Choose Affordable Destinations Without Sacrificing Experience

Research Cost-Effective Locations

Your choice of destination significantly impacts your savings. High-cost cities like London or New York can eat through your budget, while affordable hubs offer the same digital nomad perks at a fraction of the price.

-

Southeast Asia: Chiang Mai, Thailand, and Da Nang, Vietnam, India are nomad favorites. A 2024 Nomad List report ranks Chiang Mai as the top destination, with monthly costs as low as $800, including rent, food, and coworking spaces.

-

Eastern Europe: Cities like Budapest, Hungary, or Tbilisi, Georgia, offer vibrant cultures and modern amenities for $1,200-$1,800/month.

-

Latin America: Medellín, Colombia, and Quito, Ecuador, combine affordability (under $1,500/month) with reliable internet and expat communities.

Actionable Tip: Use Nomad List (https://nomadlist.com) to compare costs, internet speeds, and safety ratings. Join their community forums for real-time insights from other nomads.

Leverage Slow Travel

Slow travel—staying in one place for 1-3 months—saves money by reducing transportation costs and unlocking discounts. For example:

Long-Term Rentals: Platforms like Airbnb offer 20-30% discounts for monthly stays. A $900/month apartment in Bali could drop to $630 with a long-term booking.

Lower Transport Costs: Fewer flights or trains mean more savings. A round-trip flight from Bangkok to Bali costs $200, but staying put eliminates that expense.

Work from Coworking Spaces

Coworking spaces are often cheaper than café-hopping and provide reliable Wi-Fi and networking opportunities. For instance, Hubud in Bali charges $150/month for unlimited access, compared to $5/day at cafés ($150/month if daily).

3. Diversify Income Streams for Financial Stability

Freelance Smartly

As a digital nomad, your income is your lifeline. Diversifying revenue streams ensures you can save even during lean months.

Freelance Platforms: Sites like Upwork and Fiverr connect you with clients globally. Focus on high-demand skills like copywriting or web development, which pay $30-$100/hour.

Negotiate Rates: Don’t undervalue your work. Research market rates on Glassdoor (https://www.glassdoor.com) and pitch 10-20% above average to account for taxes and fees.

Recurring Gigs: Secure retainers with clients for steady income. A $500/month retainer for 10 hours of work provides stability without overloading your schedule.

Passive Income Opportunities

Passive income reduces financial stress and boosts savings. Consider:

Digital Products: Create eBooks, courses, or templates. For example, a $10 eBook sold 100 times monthly earns $1,000 with minimal upkeep.

Affiliate Marketing: Promote travel gear or software on your blog. Amazon Associates pays 1-10% commissions, while travel affiliate programs like Booking.com offer up to 40%.

Stock Photography: Sell travel photos on Shutterstock or Adobe Stock. A single image can earn $0.25-$2 per download, adding up over time.

Example: I earned $2,500 in 2024 from a travel photography eBook sold on Gumroad, reinvesting half into my savings. Platforms like Gumroad (https://gumroad.com) make selling digital products seamless.

Manage Taxes Efficiently

Taxes can erode your savings if not handled properly. As a nomad, you may qualify for tax benefits:

Foreign Earned Income Exclusion (FEIE): U.S. nomads can exclude up to $126,500 of foreign income in 2025 (source: IRS.gov). Consult a tax professional to confirm eligibility.

Local Tax Laws: Research your host country’s tax rules. Countries like Portugal offer tax breaks for digital nomads under the Non-Habitual Resident program.

Pro Tip: Use tools like TaxAct or TurboTax for nomads to streamline filings and maximize deductions.

4. Adopt Cost-Saving Habits for Everyday Life

Cook Your Own Meals

Eating out daily can cost $300-$500/month in affordable destinations. Cooking saves money and lets you explore local markets.

Shop Locally: Buy ingredients from markets like Mercado de Dondé Guerra in Mexico City, where fresh produce costs 50% less than supermarkets.

Meal Prep: Prepare bulk meals like stir-fries or salads for the week. A $20 grocery haul can yield 5-7 meals.

Portable Gear: Invest in a compact electric cooker ($30 on Amazon) for apartment or hostel cooking.

Use Travel Rewards and Deals

Maximize savings with travel hacks:

Credit Card Points: Cards like Chase Sapphire Preferred offer 60,000 bonus points (worth $750 in travel) after meeting spending requirements.

Budget Airlines: Book with carriers like AirAsia or Ryanair for flights under $50. Use Skyscanner (https://www.skyscanner.com) to find deals.

Travel Insurance: Opt for nomad-specific plans like SafetyWing (https://safetywing.com), starting at $45/month, to avoid costly medical emergencies.

Embrace Minimalism

A minimalist mindset reduces expenses and clutter:

Pack Light: Limit your wardrobe to versatile, high-quality items. A 40L backpack like the Osprey Farpoint ($160) fits most airline carry-on rules, saving on checked bag fees.

Buy Secondhand: Shop at thrift stores or platforms like Vinted for affordable clothing and gear.

Digital Nomad Gear: Invest in multi-use items, like a laptop stand that doubles as a phone holder ($15 on Amazon).

Saving money as a digital nomad is about intentional choices—budgeting wisely, choosing affordable destinations, diversifying income, and adopting frugal habits. By mastering these strategies, you can enjoy the freedom of nomadic life without financial strain. Start by creating a flexible budget, exploring cost-effective hubs like Chiang Mai or Medellín, and building passive income streams. Small changes, like cooking meals or using travel rewards, add up over time. Share your favorite money-saving tips in the comments below, or connect with our nomad community on [Your Blog’s Community Page]. For more nomad resources, check out our guides on [Internal Link: Digital Nomad Gear Essentials] and [Internal Link: Best Coworking Spaces Worldwide]. Let’s keep the conversation going—how do you save money on the road?

Pages

Search More Skills

Categories

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

You Won’t Believe How Easy Healthy Food Access Can Be: Solutions to End Food Deserts!

Shocking Weight Gain Risks You NEED to Know Before It’s Too Late!

Why You’re Hitting an Energy Crash (And How to Stop It for Good!)

Healthy Meal Timing: How to Fix Irregular Eating with Practical Solutions

7 Mental Health Coping Skills You NEED to Master Stress and Thrive

Bridging the Divide: Addressing Therapy Access Gaps in Virtual Anxiety Management

Recent Posts

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025