The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

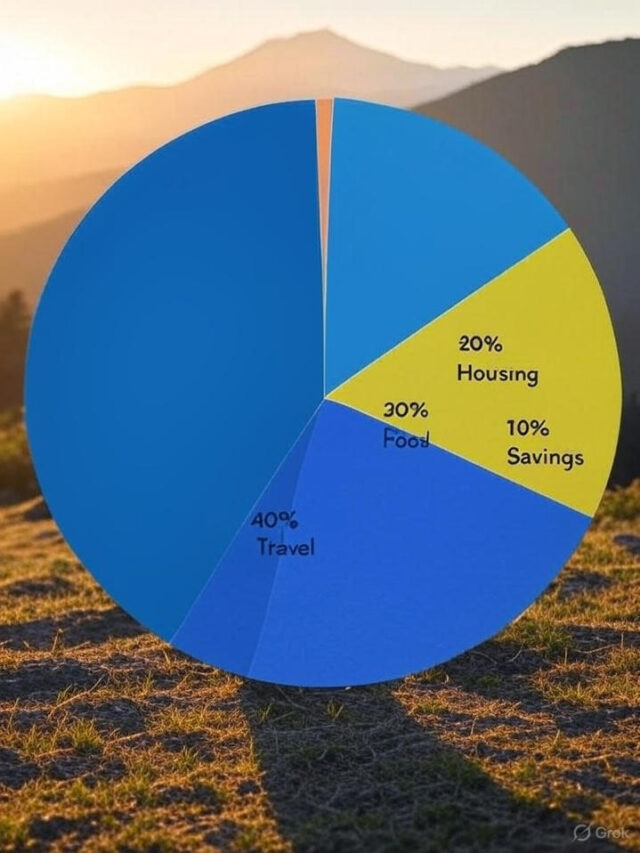

Hey there, fellow wanderer! If you’re a digital nomad like me, you know the thrill of working from a beachside café in Bali one day and a bustling co-working space in Lisbon the next. But with this freedom comes a challenge: managing your finances across borders. Fluctuating exchange rates, unexpected travel costs, and variable income streams can make budgeting feel like herding cats. That’s where the best budgeting apps for digital nomads come in—tools designed to keep your money in check while you chase your next adventure. With 15 years of blogging and living the nomad life, I’ve tested countless apps to find the ones that truly deliver. In this guide, I’ll share my top picks to help you stay financially savvy, no matter where the road takes you.

Why Digital Nomads Need Tailored Budgeting Tools

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Multi-Currency Mastery

Hop from Thailand to Mexico, and you’re juggling baht and pesos. The best apps automatically convert your spending into your home currency, saving you from calculator headaches. Look for real-time exchange rate updates—because no one wants to overspend due to outdated rates.

Location-Specific Expense Tracking

From visa fees to coworking memberships, our expenses are anything but typical. A great app lets you categorize these costs and spot trends, like how much you’re really spending on those Thai iced coffees (guilty!).

Seamless Bank Syncing

Manual entry? Ain’t nobody got time for that when you’re racing to catch a flight. Apps that sync with your bank accounts or digital wallets give you a live snapshot of your finances, wherever you are.

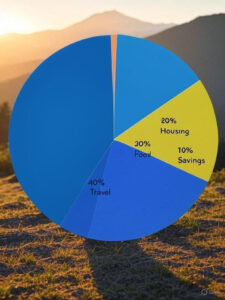

Spending Insights for Variable Incomes

Freelancers and remote workers often deal with feast-or-famine cash flow. The right app offers forecasts and breakdowns to help you stretch those lean months and save during the flush ones.

My Top Picks: The Best Budgeting Apps for Digital Nomads

After years of trial and error, here are my go-to apps that cater to our nomadic needs. Each one brings something unique to the table—let’s dive in.

1. Trail Wallet: The Traveler’s Budget Buddy

What It Offers: Built for travelers, Trail Wallet lets you set daily budgets, track expenses in over 200 currencies, and visualize your spending with colorful charts. No bank sync needed—just quick manual entries.

Why I Love It: Its simplicity is a godsend when I’m offline in a remote village. Plus, the daily budget feature keeps my spending in check during long trips.

Pros: Lightweight, travel-focused, and perfect for multi-currency tracking.

Cons: iOS-only and no bank sync—Android users, you’re out of luck.

Nomad Tip: Use it to set a daily “fun budget” for treats like gelato or souvenirs. It’s saved me from overspending in Italy more times than I can count!

2. Revolut: The All-in-One Money Manager

What It Offers: Revolut combines a digital bank account with budgeting tools. You get real-time spending alerts, auto-categorized expenses, and multi-currency accounts with interbank exchange rates.

Why I Love It: Paying for a hostel in euros while getting paid in dollars? Revolut handles it with minimal fees. The budgeting perks are a bonus.

Pros: Supports 30+ currencies, low-fee transactions, and a sleek app interface.

Cons: Budgeting features are basic compared to dedicated apps.

Nomad Tip: Link it to your freelance payments for seamless currency conversion. Check out Revolut’s site for more.

3. You Need a Budget (YNAB): The Planner’s Dream

What It Offers: YNAB’s zero-based budgeting approach assigns every dollar a purpose. It syncs with banks, tracks spending, and offers detailed reports—though multi-currency needs manual tweaking.

Why I Love It: It’s my lifeline for planning around irregular gigs. The educational resources also taught me to save smarter.

Pros: Great for long-term goals, highly customizable, and community-driven.

Cons: Subscription cost ($14.99/month) and no native multi-currency support.

Nomad Tip: Create a “travel fund” category to stash cash for your next destination. Pair it with my guide to nomadic savings.

4. PocketGuard: The Simple Spend Tracker

What It Offers: PocketGuard syncs with your accounts to show your “In My Pocket” cash—what’s left after bills and goals. It tracks spending trends and suggests savings.

Why I Love It: Its no-fuss design fits my on-the-go lifestyle. I can see at a glance if I can afford that extra coworking day.

Pros: Free basic version, intuitive, and real-time updates.

Cons: Limited multi-currency support—manual adjustments required.

Nomad Tip: Use the “In My Pocket” feature to decide if you can splurge on a local cooking class.

5. Wise: The Currency Converter King

What It Offers: Wise (formerly TransferWise) provides a multi-currency account for holding and spending in 50+ currencies, plus a debit card for easy access.

Why I Love It: It’s my go-to for sending client payments or withdrawing cash abroad without insane fees.

Pros: Transparent exchange rates, low costs, and secure.

Cons: Not a full budgeting app—pair it with another tool for tracking.

Nomad Tip: Hold USD, EUR, and AUD in one account for flexibility. Visit Wise’s site to set it up.

How to Choose the Right App for You

With so many options, how do you pick? Here’s a quick decision guide based on my experience:

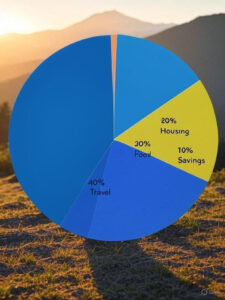

Short Trips: Trail Wallet for its daily budget focus.

Frequent Transactions: Revolut or Wise for currency ease.

Long-Term Planning: YNAB for its depth.

Simplicity: PocketGuard for quick insights.

Mix and match if needed—I often pair Wise with YNAB for a powerhouse combo. A 2023 Statista report noted that 45% of remote workers use multiple financial apps, so don’t be afraid to experiment!

Bonus Tips for Budgeting Like a Pro

Track Offline: Keep a small notebook for cash spends in areas with spotty internet—sync later.

Set Alerts: Use app notifications to catch overspending early.

Review Weekly: Spend 10 minutes every Sunday analyzing your week’s expenses. It’s a game-changer.

After 15 years of living and blogging as a digital nomad, I can tell you that financial freedom is the backbone of this lifestyle. The best budgeting apps for digital nomads—like Trail Wallet, Revolut, YNAB, PocketGuard, and Wise—offer the tools to make it happen. Whether you need multi-currency magic, real-time tracking, or long-term planning, there’s an app here for you. My advice? Test a few, find your fit, and watch your stress melt away. What’s your favorite budgeting trick or app? Drop a comment below—I’d love to hear from you! And if this guide helped, share it with your nomad crew. Safe travels and happy budgeting!

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025

Pages

Search More Skills

Categories

Recent Posts

Retirement Planning for Digital Nomads: A Roadmap to Financial Freedom on the Move

Tax Strategies for Digital Nomads: A Comprehensive Guide to Staying Compliant and Saving Money

Saving Money as a Digital Nomad: A Comprehensive Guide to Financial Freedom

The Best Budgeting Apps for Digital Nomads: Managing Finances on the Go

AI Writing Tools: Your Ultimate Guide to Smarter Content Creation in 2025