Introduction

Challenges of Saving money— many people try it, but in the end, most of them finish with an empty bag. The term Saving Money is enough to demonstrate what it is. No need to explain it more, right? If you are a newbie in saving money you first learn to avoid the challenges while planning for saving money. Without it, you will never get your desired result. For those who have been trying to save money for the last few years, but cannot succeed, this article is also for those people. Let’s begin without further delay.

Understand the Mind Set:

The biggest challenge that comes in the way of saving money is the mindset. People think Saving money refers to cutting down the luxuries and living a compromised life. That’s not true. Even I was also thinking like this. Your saving money challenge will be ended when you understand the fact that saving money is not cutting your luxury but it is a decision that prevents you from doing some unnecessary expenses. However, it is not easy to cut down the unnecessary expenses. In this article, you will mainly learn the challenges of unnecessary expenses and how to overcome these:

1. The Emotional Buys:

You can buy a newly launched gadget or the latest fashion trend, but it will destroy your savings plan. When you feel the urge to buy something while observing its hoarding or watching the commercial, you simply close your eyes and sleep for a while. All the commercials are designed to emotionally propel for buy things. It’s like addiction, sleep for a few minutes will resist your buying urge and prevent unnecessary expenses. You can learn to differentiate between needs and wants.

2. Monthly Budget:

Those who fail to save must not have a monthly budget. Even though they have a monthly budget, they failed to stick to their budget plan. It is good to have flexibility in the budget to meet the emergencies. If it becomes a loophole for unexpected bills and fluctuating expenses, then it is not good for saving projects. Lifestyle changes are another thing that drain your budget and prevent your savings. So it is a crucial part of saving to make a monthly budget and stick to it till the end.

3. Emergency Fund for Rainy Day:

All your days will be never the same. There are many challenges and situation arises in life. These are normal and you need to be prepared for all these situations with an emergency fund. An emergency fund may be utilized in case of a medical emergency, car repair, theft or other mishappens and at the time of unexpected unemployment. Without a dedicated emergency fund, you won’t manage this situation and your saving money will be sacrificed.

4. Debt Repayment:

It is too difficult a task to create a balance between debt repayment and saving. It is like an extra burden on your financial condition. In that case, you need to prioritize things, which should give more priority to either your savings or the repayment of the loan. Debt fetches more priority, but you can effectively manage your savings too. You need careful planning for saving and adequate discipline. People take into debt due to a lack of stable finances and only regular saving can stabilize the personal finances.

5. Future & Retirement Planning:

You save now and will be rewarded later. Your saving is not for your present life. You can secure your future and fix your retirement day with enough money in your hand. For that, you have to start saving early. Lack of knowledge about investment, employer benefits, and long-term financial gain, you may not be able to save properly. Go and learn things properly.

FAQ: Your Saving Money Queries Answered

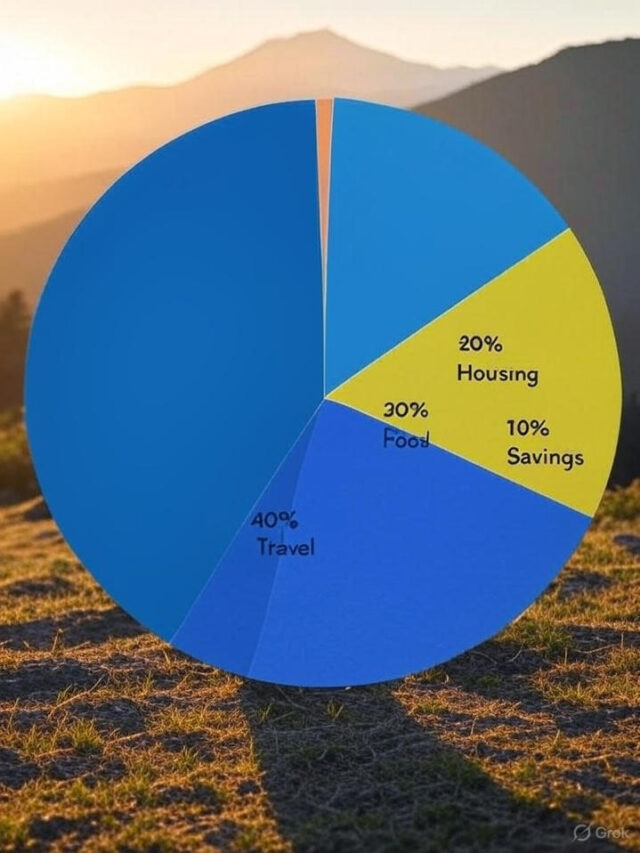

Q1: How much should I save each month?

A1: It is treated as ideal, if you save a minimum of 10-20% of your income, or else you can set your saving goals as per your income, expense, and priorities.

Q2: Should I pay off debt or save first?

A2: Both are equally important. You should decide as per your priority. You should build an emergency fund simultaneously along with your saving to handle such type of situation.

Q3: How do I stay motivated to save?

A3: Set clear goals, celebrate milestones, and track your progress regularly—Automate savings where possible to make it easier and more consistent.

Conclusion

Saving money can be challenging, but with awareness, planning, and perseverance, you can overcome these challenges and build a more secure financial future. Remember, every small step you take today brings you closer to your goals tomorrow. Embrace the journey and empower yourself with the knowledge to navigate its twists and turns. Your financial well-being is worth the effort.